Redesigning Fraud & Dispute reporting for a leading Bank

Mobile first | IXD | Banking

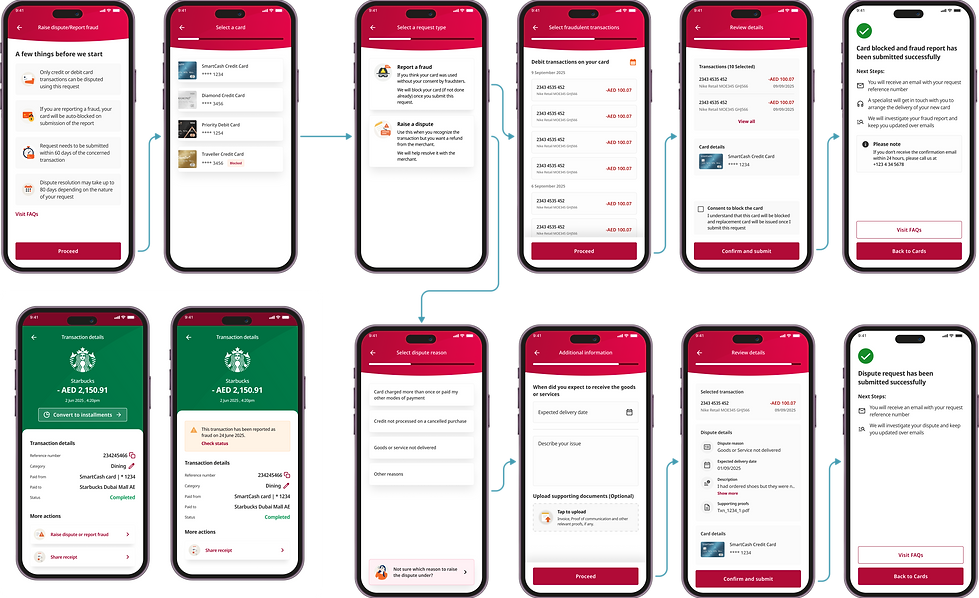

Moving from a manual, paper-based process to a secure, 3-phase digital journey.

Role

Product designer

Timeline

2025

Tools

Figma, 11FS Pulse

The project brief

The Mission

To digitize the card dispute lifecycle, reducing call center dependency while providing fraud victims with instant security and transparency.

The Problem Statement

How might we transform a high-friction, 48-hour manual process into a real-time digital experience that protects users and simplifies bank operations?

The Deliverables

A cross-platform UI system (Mobile/Desktop), a foundational Transaction Detail IA, and a comprehensive Service Blueprint for backend alignment.

THE CHALLENGE: A SYSTEM IN CRISIS

The Problem

Research revealed that 71% of customers defaulted to the call center because digital paths were non-existent.

The Fraud Reality

87% of cases were fraud-related, yet the manual process left users exposed to further theft while they waited for a PDF to be processed.

Operational Burden

99% of forms were handwritten, forcing staff into a cycle of manual data entry and error-prone uploads.

Strategic Goals: Target KPIs

40% Call Reduction

Shifting new dispute queries from phone to in-app.

100% Digital Capture

Eliminating manual data entry for Card Operations.

Secure by Design

Mandatory card blocking for 100% of fraud reports

Data Integrity

Maintaining integrity of the data

Design Process

I followed the Double Diamond framework to ensure we were solving the right problems before designing the right solutions.

01

Discover

Analyzed CX insights, user pain points, and competitor journeys.

02

Define

Mapped current journey & identified opportunity areas.

03

Ideate

Brainstormed on solutions, created flows, blueprints & UI concepts

04

Deliver

Designed high-fidelity screens with dynamic logic, auto-card block, and success confirmations.

Discovery: Secondary Research & Benchmarking

I benchmarked leaders like ENBD, Revolut, and HDFC.

Key Insights

Most regional competitors treat fraud as a "Support Ticket" hidden in deep menus, which forces users to search while panicking.

Global leaders like Revolut use "Instant Card Freezing" as a primary trust-builder.

A major pain point is the waiting period after dispute is raised where user is unaware of the updates.

Redefining categories

I used Affinity Mapping exercise with internal stakeholders to translate 12 dispute reasons into 5 human-centric categories. This reduced cognitive load while remaining VISA/Mastercard compliant.

Defining the user

Stakeholder Ecosystem

Navigating stakeholder friction

Conflict

The Product Owner (PO) initially feared Multi-Transaction Selection would lead to "random" reporting.

Design Resolution

I introduced "Smart Friction" - a mandatory Review screen and a high-stakes Card Block warning to ensure intentionality.

Designing the Invisible: Service Blueprint

I created a Service Blueprint to align the front-end experience with the back-end logic for Card Ops and the FRMU.

The ‘Mini’ Project: Identifying Gap in IA

IA Gap

I identified that the app lacked a Transaction Detail Page, which meant there was no contextual "home" for reporting a charge. This would increase customer frustration in high-stress situation when they would want to report a transaction quickly.

The Pivot

I designed the Transaction Detail page from scratch to act as the primary gateway.

The Final Experience

Feature visibility

New transaction page enabled visibility of revenue generating ‘Installments’ product.

Eliminating Discovery Friction through Contextual Shortcut

By integrating the dispute trigger directly into the transaction level, the need for users to navigate deep menus during a crisis was eliminated.

Designing for High-Anxiety

In "panic mode," cognitive load is high. By providing clear, distinct pathways for Fraud and Disputes, the UI acts as a guide, reducing decision paralysis when the user feels most vulnerable.

Setting expectations

early on

Security requirements, like mandatory card blocking, are introduced early to set expectations. This prevents "surprise friction" later in the journey, ensuring the user is mentally prepared for the operational consequences of their report.

Strategic Reassurance & Guided Next Steps

The integration of a prominent FAQ button allows the user, who is now in a calmer state, to proactively explore the investigation timeline and recovery process, reducing the need for follow-up inquiries to the bank.

Reflections

Success in banking is measured by how quickly panic is turned into security. This project taught me that "Smart Friction" can be a powerful tool to satisfy stakeholder fears while empowering users.